Market Insight for March 8

The Canada Mortgage and Housing Corporation (CMHC) has officially terminated the First-Time Home Buyer Incentive program. The cutoff for new or revised applications is set for March 21st, 2024. The program aimed to help first-time home buyers boost their down payment...

Market Insight for March 1

Tarion, the home consumer protection agency in Ontario could face $90M in claims as developers walk away from projects and home buyers lose deposits. Ontario's real estate watchdog, Tarion, confronts an unprecedented challenge as it braces for over $90 million in...

Market Insight for February 16

So it’s official! City Council voted in favour of the 9.5% increase to the residential property tax rate when they met on Wednesday to finalize the 2024 budget. The tax hike, bigger than any since the city’s amalgamation in 1998, was opposed by some councillors, who...

Market Insight for February 2

Toronto listings are starting to see multiple offers starting up again. What has happened in the last week that has caused this frenzy? The psyche in the market has already started to shift. Could it be this unusually warm weather we are having? Does it feel like...

Market Insight for January 26

Foreign buyers who want to purchase a home in Toronto could soon face an even steeper price tag if city council approves a new municipal tax that aims to curb real estate speculation. The Municipal Non-Resident Speculation Tax (MNRST), is currently under consideration...

Market Insight for January 19

Have you done your declaration for your home occupancy status for 2023? The City of Toronto is reminding all residential property owners to declare their property’s occupancy status for the 2023 taxation year by February 29, 2024. As part of the Vacant Home Tax...

Market Insight for January 5

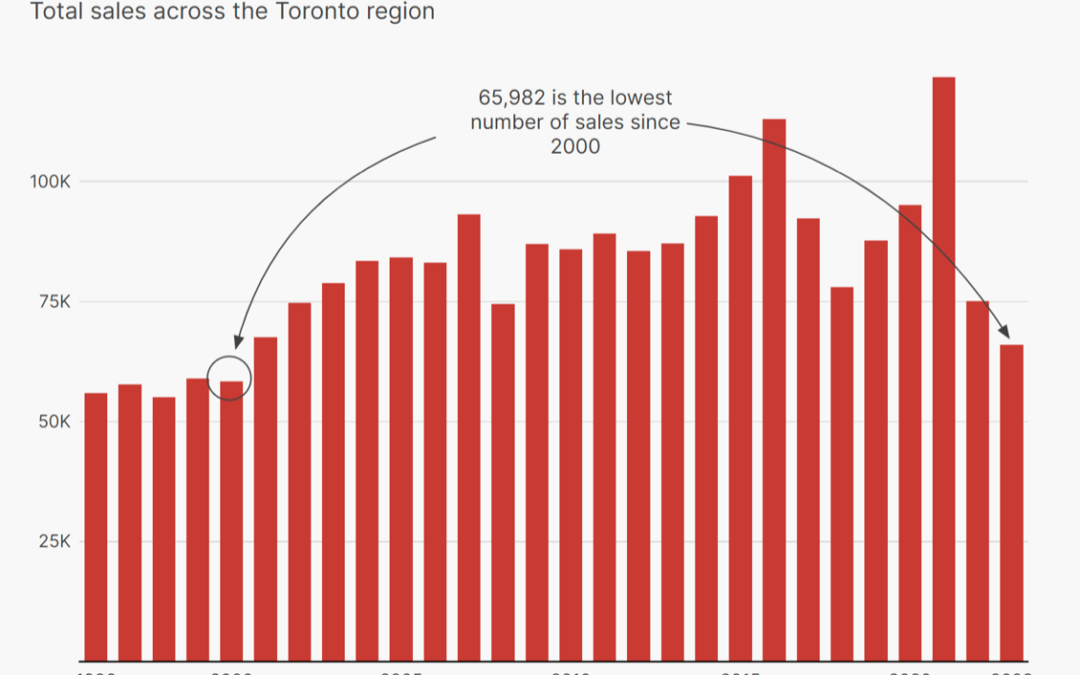

Toronto’s latest real estate figures suggest the housing market may be amid a rebound, according to some economists, though they caution that the full impact of elevated mortgage rates has yet to play out. The December stats were released from the Toronto Regional...

Market Insight for December 8

The blind bidding war has been a fixture of Canadian real estate for a generation, but even with new rules in Canada’s largest real estate market that will allow realtors to part the veil of secrecy, industry experts don’t believe an era of open auctions is upon us....

Market Insight for December 1

The Bank of Canada is widely expected to hold its benchmark interest rate when it meets next week, but a lot has changed since October. Cooling inflation, here and south of the border, and a weakening economy have turned markets’ attention from rate hikes to rate...

Market Insight for November 24

Getting on the property ladder is so tough these days more young Canadians despair of ever getting to the first rung. Prices have cooled since the pandemic housing boom, but higher mortgage rates are a new hurdle for would-be buyers. A new study by Statistics Canada...