Market Insight for January 5

The December stats were released from the Toronto Regional Real Estate Board this week and data shows that the GTA saw 3,444 home sales in December, an 11.5 per cent increase compared to a year ago and that the average price for a home climbed 3.2 per cent to $1,084,692.

The average price for detached, semi-detached and townhomes all increased year-over-year by 2.5 per cent, 1.7 per cent, and 5.5 per cent, respectively, while condos saw a 3.1 per cent decrease. It’s been a challenging year for the condo market, which is largely driven by investors, many of whom are over-leveraged and have been selling their units at discounted prices.

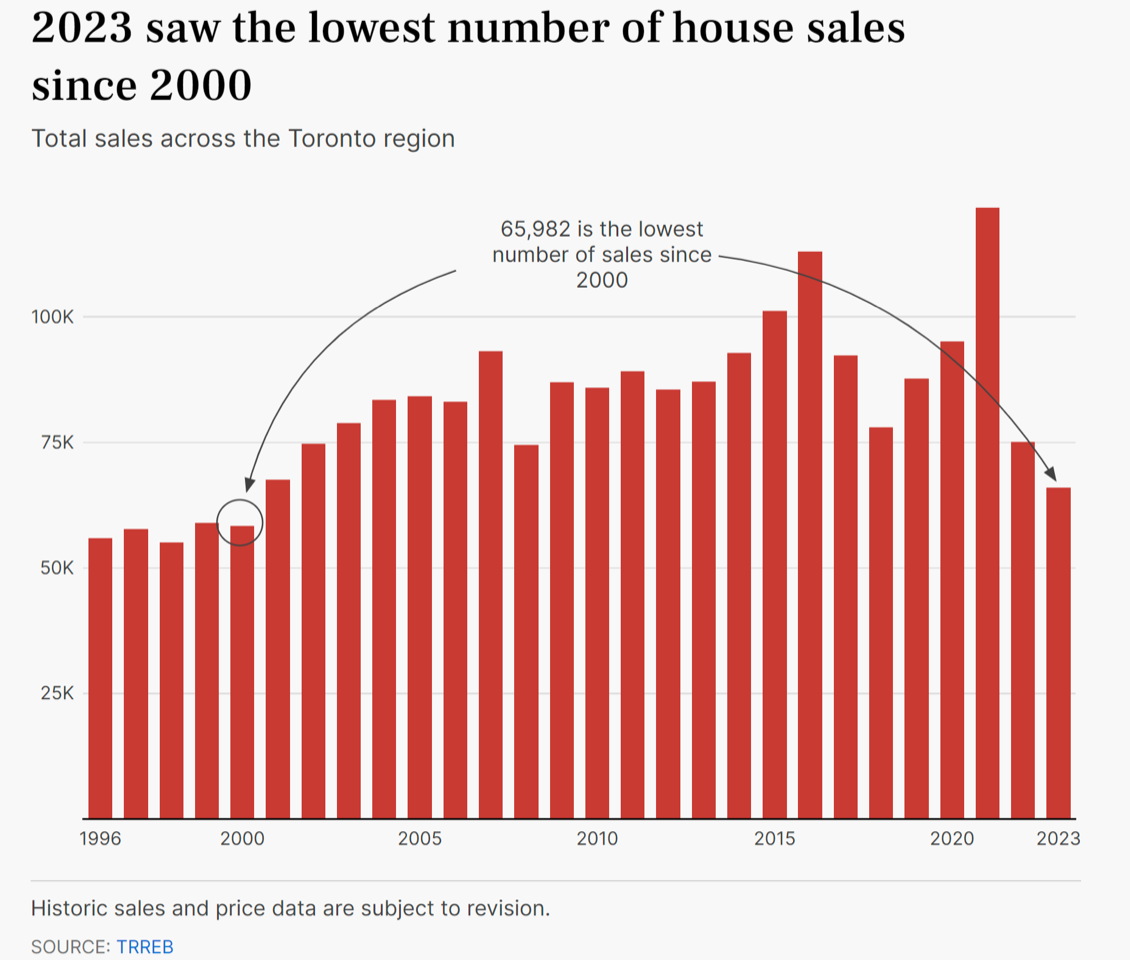

There were 65,982 total home sales reported through TRREB’s MLS® System in 2023, a 12.1 per cent dip compared to 2022, the lowest sales recorded since 2000, when Toronto’s population was two-thirds its current size and the average price of a home was $243,000. Even during the 2008 financial crisis, home sales hit 74,500. By comparison, home sales reached a record 121,700 during the 2021 pandemic real estate frenzy when buyers jumped into the market taking advantage of historically low-interest rates.

Despite an uptick during the spring and summer, the number of new listings also declined for the third straight month. The average selling price for all home types in 2023 was $1,126,604, representing a 5.4 per cent decline compared to 2022.

Buyers who were active in the market benefited from more choices throughout 2023. This allowed many of these buyers to negotiate lower selling prices, alleviating some of the impact of higher borrowing costs. Assuming borrowing costs trend lower this year, look for lighter market conditions to prompt renewed price growth in the months ahead.

There could be some relief on the horizon. Economists forecast that the Bank of Canada could begin to cut rates by April, allowing for renewed buyer interest. It could revive the market come spring. Already bond yields are trending down resulting in declining interest rates on five-year fixed mortgages.