Market Insight for January 17

It was the worst year since the late 1990s for the preconstruction condo market, with investors souring on buying new units because they are no longer profitable.

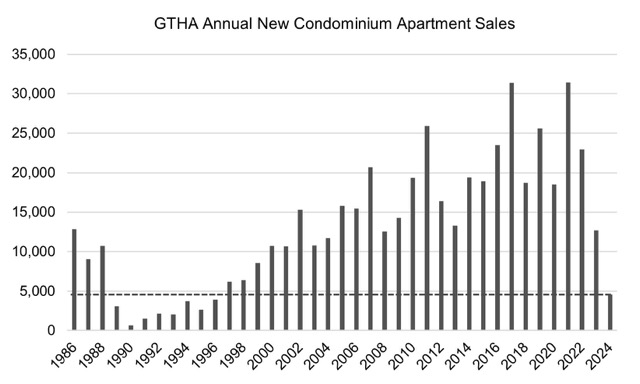

The Greater Toronto Hamilton Area (GTHA) new condominium apartment market reported a total of 4,590 sales in 2024, declining for the third straight year with a 64% drop from 2023 (12,696 sales) and a 78% decline compared to the latest 10- year average (20,835 sales). Last year marked the slowest year for new condo sales in the GTHA since 1996.

The year 2024 proved to be particularly challenging for new condos in the GTHA and those who invested in them. This is highlighted by data from research and consultancy firm Urbanation, which shows that 14 condo projects were cancelled during the year. These cancellations represented a loss of 2,805 new units that had been expected to enter the GTHA’s market.

Urbanation President Shaun Hildebrand says that this is the highest number of condo units cancelled in a year since 2020 (the first and most restrictive year of the pandemic), when 3,087 units were cancelled across 10 projects. He also notes that of the 14 projects cancelled last year, six were converted to rental, totalling 1,434 units.

“There are a whole bunch more that are in receivership, have paused sales, and are very likely to cancel, but haven’t actually given purchasers their deposits back,” Hildebrand adds. “It’s difficult to put a number to it, but there are likely more cancellations coming in 2025.”

Looking at just the fourth quarter, Urbanation reports that 802 units were presold, up 12% from the quarter prior but down 71% year over year — and representing the lowest fourth quarter for sales

since 1993.

Against that sluggish backdrop, just six condo projects launched for presales in the fourth quarter, and even more dismal, just 10% of the 1,829 units launched actually sold.

In the city of Toronto, the average asking price was $1,153 per square foot in the fourth quarter compared with $1,407 a year earlier. In the suburbs and regions surrounding the city, the average asking price was $1,104 per square foot in the fourth quarter versus $1,183 in the previous year.

Meanwhile, there were 24,277 unsold condo units in various stages of development in 2024, including those in pre-construction, under construction, and recently completed. That figure was up 6% from the previous year-end high of 22,978 units in 2023, and 50% above the 10-year average of 16,154 units.

Thursday’s report says that it would take 64 months to clear current unsold inventory at the 2024 level of sales — a record high that is nearly six times higher than a balanced level of inventory at 10-12 months of supply.

Urbanation President Shaun Hildebrand emphasizes that the GTHA’s new condo market has just experienced its most difficult year in thirty years. “Market expectations remain subdued this year as investors—the key force behind presale activity—face ongoing challenges with negative cash flow, financing hurdles, and falling prices and rents,” he explains. “The slowdown in presale activity will further hinder construction starts in 2025, leading to a significant reduction in new supply by 2026-2027.”

Urbanation reported that 1,506 new condos started construction in the fourth quarter, representing a 59% decrease year over year. Over the entirety of 2024, just 9,258 new units were started, down 51% from the 18,950 units started in 2023, and 56% off the 10-year average of 21,213 units. The last year that the level of condo starts were this low was 2002.