Market Insight for February 7

Despite this, the Toronto Regional Real Estate Board (TRREB) forecasts a stronger housing market in 2025, with home sales expected to be 12.4 per cent higher, totaling 76,000 transactions across the region. Lower borrowing costs are anticipated to enhance affordability.

With the Bank of Canada having reduced interest rates six times since June, the average five-year fixed mortgage rate now sits just above 4 per cent, down from approximately 5 per cent a year ago. TRREB projects the average home price to climb to $1,147,000, reflecting a moderate 2.6 per cent increase from last year, with single-family homes expected to experience the most significant price growth.

“A growing number of homebuyers will take advantage of lower borrowing costs as we move toward the 2025 spring market, resulting in increased transactions and a moderate uptick in average selling prices in 2025,” said TRREB chief market analyst Jason Mercer in a press release.

However, the benefits of lower mortgage rates could be partially offset, at least in the short term, by the potential negative effects of trade disruptions on the economy and consumer confidence.

The report referenced data from Ipsos, which found that 28 per cent of respondents indicated they are likely to purchase a home in 2025, while 37 per cent signaled an intention to sell. Both results were in line with 2024 polling.

First-time buyers represented 42 per cent of prospective homebuyers. Uncertainty surrounding possible U.S. tariffs and their implications for Canada’s economy and housing market has led some buyers to hesitate before making an offer. In January, TRREB reported that home sales declined 7.9 per cent year-over-year, with 3,847 transactions recorded.

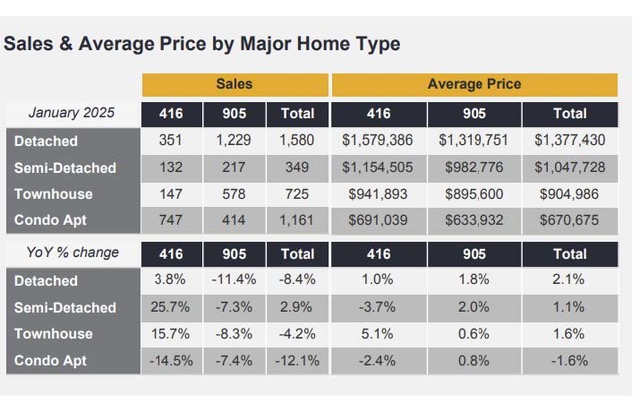

The average selling price rose to $1,040,994, reflecting a modest 1.5 per cent increase compared to January 2024. The composite benchmark price, which captures the typical home, increased by 0.44 per cent year-over-year.

The Greater Toronto Area saw 12,392 new listings in January, marking a substantial 48.6 per cent rise from a year earlier. In the City of Toronto, there were 1,386 home sales in January, a 4.7 per cent decline from last year. Across the rest of the GTA, home sales dropped 9.6 per cent to 2,461.

Sales of semi-detached homes in the GTA increased by 2.9 per cent in January compared to a year ago. All other property types experienced year-over-year declines. Condominiums had the most notable drop at 12.1 per cent, followed by detached homes at 8.4 per cent and townhouses at 4.2 per cent.