Market Insight for December 6

Real estate agents who had maintained hope that Toronto’s housing market would recover from its significant slump this year are now seeing their optimism validated. Buyer enthusiasm has returned, driving up sales figures, and in some cases, by impressive double-digit margins.

According to the November market watch report released this week by the Toronto Regional Real Estate Board (TRREB), residential real estate transactions in the GTA saw a year-over-year increase of 40%.

The board highlighted the impact of reduced interest rates on stronger sales volumes, tighter market conditions, and resulting price increases. However, one segment continues to lag, with prices remaining below last year’s levels.

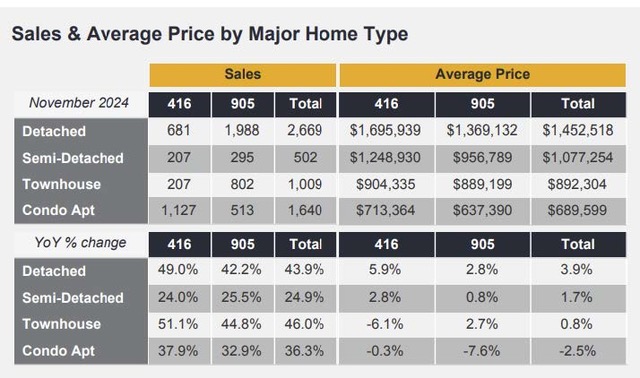

Condominium prices, which have struggled due to declining investor interest, were 2.8% lower on average this November compared to last. In contrast, the average price of a detached house rose by 3.5% year-over-year, semi-detached prices edged up by 1.7%, and townhome prices increased by 0.8%, signaling gradual recovery.

Over the month of November, TRREB recorded 5,875 home sales, down from October’s 6,658 transactions. These two months of promising sales activity represent a break in the holding pattern that has existed for months now, even despite interest rate cuts.

Of the nearly 6,000 homes sold in November, the lion’s share were single-detached, which constituted 2,669 of total sales, followed by 1,640 condos, 1,009 townhouses, and 502 semi-detached homes.

On the supply side, new listings were up compared to November 2023, but by a much lesser annual rate, causing the market to tighten. In total there were 11,592 new listings, up by 6.6% year-over-year. The average sale price for November was $1,106,050, up 2.6% year-over-year.

Still, there is a substantial glut of resale homes still sitting on the market. They are also lagging on the market longer, with average days on market coming in at 31 compared to last November when it was 25 days on market.

With selling prices remaining well off their historic peak and monthly mortgage payments trending lower, the stage is set for an accelerating market recovery in 2025.

Other experts likewise feel there will be more competition, faster sales, and escalating price points as we move into the New Year, though they emphasize how much the months ahead are dependent on rate cuts and how lenders interpret new mortgage regulations, and that nothing is guaranteed.