Market Insight for Sep 29

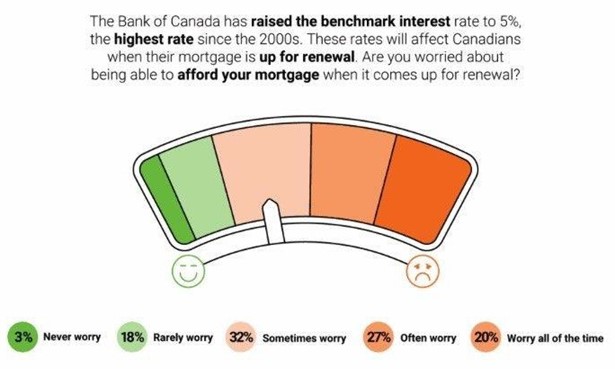

Twenty percent of homeowners “worry all the time” about their ability to afford their mortgage when it comes up for renewal — a figure that has risen 9% in just a year — and another 27% “worry often.” Just 3% were unbothered by the proposed predicament.

Amidst stubbornly high inflation, more than 9% of homeowners are already struggling financially, and nearly 30%are in a “tight” financial situation but are managing.

The findings polled 800 Canadians on their home-buying experience and sentiment, as well as their feelings on the economy and real estate market.

The majority of homeowners surveyed are up for renewal in the next two to three years. If they opted for a five-year fixed-rate mortgage, which has historically been the most popular in Canada, they did so when the Bank of Canada’s (BoC) overnight rate was between 0.25% and 1.75%. It’s now at 5%.

For those on a variable-rate mortgage, though — particularly those with fluctuating payments — the anxiety has been realized 10 times over since the Bank of Canada began hiking rates in March 2022. One respondent who purchased a home in 2021 said their monthly mortgage payments have already risen by roughly $2,500.

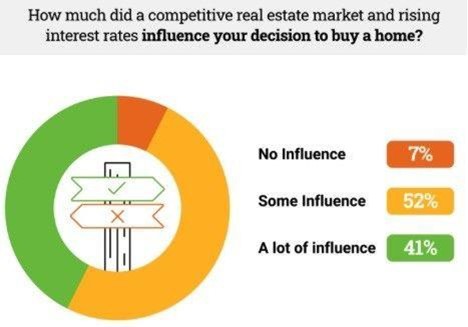

In addition to causing anxiety for the future, interest rates also played a role in a homebuyer’s initial decision to purchase property. Forty-one percent of those surveyed said rising rates and a competitive real estate market had “a lot” of influence on their decision to buy a home, and another 52% said the factors had at least “some” effect.

While many economists believe the BoC will begin cutting interest rates in early to mid-2024, there is little consensus on whether they will hike again in the interim, with the bank itself stating it is “prepared ” to do so if underlying inflationary pressures persist.

Should such a situation occur, 9% of survey respondents said they would be unhappy in their home. However,45% indicated they would still be happy even if the BoC delivers another hike before the end of the year — a “hard-pressed but happy outlook” on homeownership.