Market Update for July 15

Inflation, rising interest rates that make financing homebuilding and homebuying more expensive, and higher construction costs are just a few of the myriad factors that, together, could send a shock through Toronto’s new-housing pipeline, experts warn. Faced with increasingly unpredictable and rising construction costs, developers may opt to cancel rental and condo projects currently underway, leaving thousands of homebuyers potentially in the lurch.

Since early 2016, costs for “formwork” — which represents the lion’s share of building costs by dollar value and is the structure’s reinforced concrete bones and foundation — have more than doubled. When you have your largest trade going up that fast, it’s a huge impact on the bottom line as well as a skilled-labour shortage and escalating material prices as causes.

Precise data on Toronto housing cancellations aren’t the easiest to come by. Sometimes, a developer will quietly shutter a sales office for a new development, or a project perhaps hasn’t even reached the point of sales before the plug is pulled. There are, however, multiple indicators that suggest the rate of homebuilding in Toronto and the surrounding GTA is indeed slowing. Two months ago, Colliers International began tallying canceled and indefinitely shelved residential projects, including all housing types, across the GTA. To date this year, 45 developments aren’t moving forward as planned, based on Colliers’ discussions with developers and cost consultants. The names of any projects in question were not disclosed citing client privacy.

The scrapped builds include eight rental developments and six low-rise subdivisions, with the remainder being condos. These include projects that have been totally scrapped and others that are likely to relaunch with higher prices later, as well as proposed rental buildings that are being reworked into condos.

To get a more complete picture of the market, it’s worth looking at the pre-construction pricing for units that sold about a year ago, notes Shaun Hildebrand, president of Urbanation, a Toronto-based development consultancy. Upwards of 5,000 units that sold at a rate of $1,000 per square foot or less more than a year ago just aren’t financially viable anymore. “Many of those are likely to cancel, and there are likely others that have been delayed in terms of starting construction and risk canceling given the cost environment.” He said building costs are up approximately 20% year-over-year and are now rising “much faster” than real estate, which could result in some projects “no longer being economically feasible to proceed with.” Rising labour costs and record low unemployment are also a factor, according to Hildebrand.

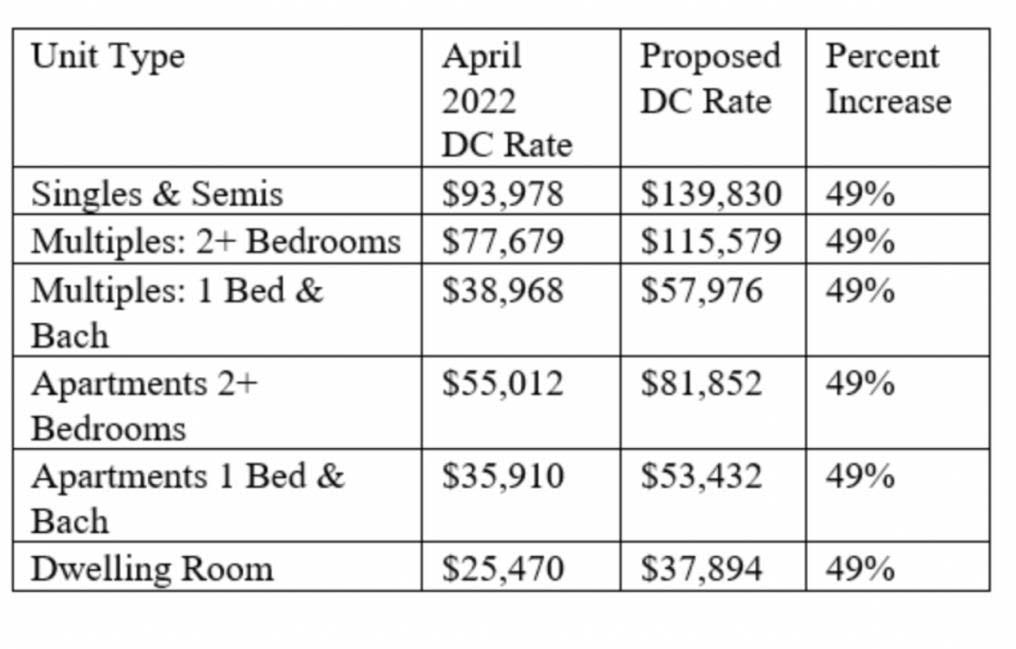

If that wasn’t enough, the cost of building housing in Toronto will soon rise by tens of thousands of dollars per unit as the city hikes development charges (DC) by nearly 50 percent.

The fees, which are charged to developers and help pay for the associated capital investments required to support new development, are evaluated every five years using a long-standing formula.

City officials maintain that even with the increases, Toronto will still have cheaper development charges than several neighbouring municipalities, including Markham, Mississauga, and Vaughan.

The hike, which is set to be formally approved by Toronto’s City Council this month, is slated to take effect in May 2023 when the existing bylaw expires, with the other half being phased in the following year.